NEW! Advanced ONLINE PRESENTATION Skills

There are a different set of skills required for presenting online! Everything is smaller, and so is your impact if you don’t adapt. Fortunately, there are simple yet profound strategies that help you become more engaging, clear, and compelling when you’re presenting online.

This workshops will teach you strategies used by top presenters to engage audiences, deliver their unique value more clearly, and create more compelling calls to action. You’ll walk away with strategies you can use in your next presentation.

You’ll Learn:

- Avoid meeting traps most presenters miss

- Capitalize on the underrated visual power of online meetings

- Manage information so clients learn more and like it better

- Engage clients when you can’t see their body language

- Deliver a more consultative – and valuable – online experience

COMING SOON! The Hybrid Advisor: Go-Forward Strategies for Success

The pandemic opened everyone’s eyes to the advantages of using technology to communicate, build relationships, deliver financial advice. The “normal” that results from this seismic shift will see advisors incorporating technology strategically into a hybrid service model that enhances both the client experience and their own productivity. The next top advisors will be hybrid!

You’ll Learn:

- What “Hybrid Advising” really means

- Why the future – and present – belongs to hybrid advisors

- How top advisors are choosing the right path for clients

- Essential hybrid skills that add value in any environment

- Communication “hacks” that increase productivity

- Essential client communication tech for the hybrid advisor

The Psychology of Advice

We’re all subject to certain cognitive biases that affect how we interpret inputs and make decisions. When you understand how biases and heuristics affect business relationships, you can avoid traps that make you seem “salesy” and position yourself as a higher-level consultant.

This workshop helps you apply Ten Fundamental Principles that profoundly impact client communication, relationships, and trust. You’ll walk away with strategies you can apply in your very next client meeting to achieve better results.

You’ll Learn:

- Crash Course: How humans evaluate inputs and make decisions

- How Cognitive Biases profoundly affect your business relationship

- Science-based strategies for offering advice clients are more likely to trust

- Avoiding cognitive traps that plague advisors in every discipline

- Best interest strategies that help you help clients make – and commit to – good decisions

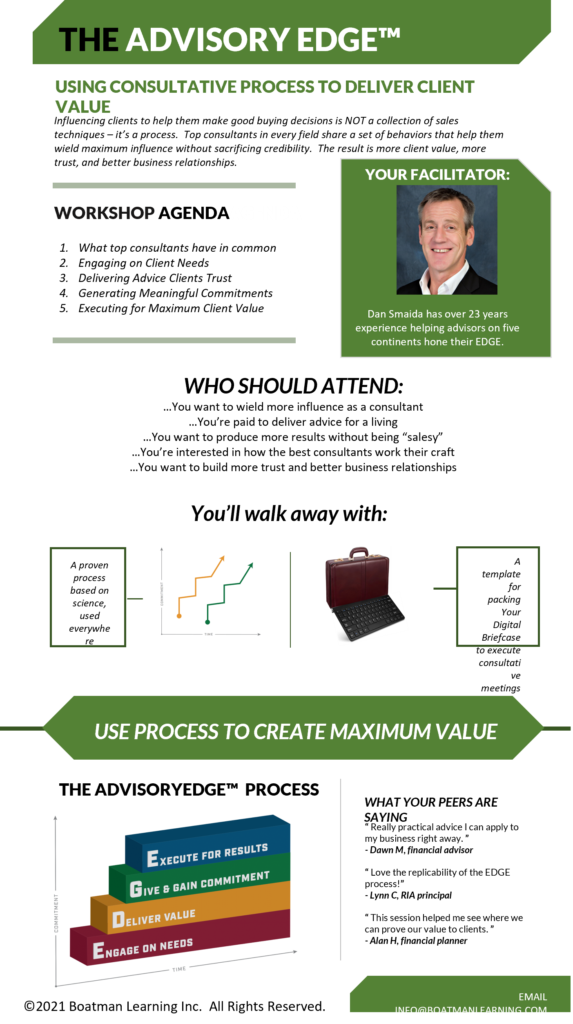

Sell Without Selling: Consulting Skills for Financial Advisors

Clients are warier than ever of traditional, typical sales behaviors. Unfortunately, we all fall into cognitive traps that lead us to offer premature or unsolicited advice that clients resist or reject. Top advisors in every discipline use CONSULTATIVE PROCESS to avoid these traps and position their advice differently in clients’ minds.

This workshop shares the consultative process TRUE advisors use to differentiate and win clients’ hearts, minds, and actions. You’ll walk away with strategies you can use immediately to persuade more effectively.

You’ll Learn

- Crash Course: Cognitive Traps that make advisors unintentionally salesy

- How TRUE Advisors position themselves to offer advice clients trust and take

- The AdvisoryEDGE consultative process and how it helps clients

- Using process to manage client meetings for better results

- Avoiding traps and taking the consultative path in typical client situations

Interested in a Workshop?

We don’t offer public workshops – we work in partnership with some of the world’s top insurance and fund companies to develop advisors. Contact us to find out which of our business partners sponsors workshops for your organization.

CONTACT US